Good morning! This is the sixth edition of the Compliant Connect newsletter.

The goal is simple: to keep you in the loop on what the FTC and other regulatory agencies are up to so that you can protect yourself.

These newsletters will land in your inbox twice a week – Mondays and Thursdays.

Remember: this is NOT legal advice, only information!

Here’s the rundown today…

- 👀 FTC Calls Out Social Media Companies

- 💊 New Lawsuit Against “Drug Middlemen”

- 💰 “BizOpp” Company Settles With The FTC – What We Can Learn

- 🏛️ Important California Rule Every Business Needs To Know

- 📝 Why The FTC Uses Section 19 – Explained

Compliance Digest: What You Should Read Today

FTC: Social Media Companies Engaged In “Vast Surveillance”

The FTC’s new report claims that the largest social media platforms are collecting mass amounts of data to monetize their users WITHOUT adequate safeguards.

The report calls out Amazon (Owner of Twitch), Facebook, YouTube Twitter/X, Snap, ByteDance (TikTok), Discord, Reddit, WhatsApp and others.

The FTC claims that these companies are handling data in a way that could lead to privacy infringements, identify theft, stalking and more.

The FTC says that children and teenagers are most at risk.

Here is a link to the report.

FTC Sues “Drug Middlemen” For Inflating Insulin Prices

As a part of its focus on anti trust, the FTC is suing the 3 largest pharmacy benefit managers who it accuses of increasing the price of insulin by over 1200%.

The FTC alleges that in many companies these companies chase higher rebates rather than recommending the lowest cost option for the consumer. The details of the complaint should be released later today.

While insulin the focus of this lawsuit, this could impact other drugs as well.

New FTC Settlement Hits Business Opportunity Company

The FTC has settled with the third defendant who operated a business opportunity company called Blueprint to Wealth.

In addition to the financial penalty, the settlement calls for a ban on selling money-making opportunities, along with a ban on any involvement with robocalls.

We break down the details of the case in the next section.

Case Breakdown: Blueprint To Wealth

This case from last year caught our attention because it was finally settled this week.

It’s a good one for us to look at because it features some common violations that the FTC targets, especially with companies that are in the business or investment opportunity spaces.

The defendants sold a membership program that cost between $3,000 and $21,000. That membership program gave members 2 things…

- Members were able to sell digital products created by the company.

- Members could generate income by driving new sales for the program.

This program was sold over the phone, which exposed them to Telemarketing Sales Rule violations.

Remember, if you sell over the phone, you are at a HIGHER level of risk!

Here are some of the key takeaways from the FTC’s complaint letter.

Remember: This is the FTC’s point of view.

#1 – Customer Complaints

The FTC claims that “consumers have filed more than 230 complaints with the FTC regarding robocalls, including ringless voicemails, associated with Defendants’ Blueprint to Wealth scheme.”

Customer complaints – especially if they are being sent directly to the FTC – are a common way a company gets on the FTC’s radar.

#2 – Not Getting Proper Authorization

The defendants were accused of reaching out to prospects with pre-recorded sales message WITHOUT getting their consent. This is a violation of the Telemarketing Sales Rule.

#3 – Earnings Claims

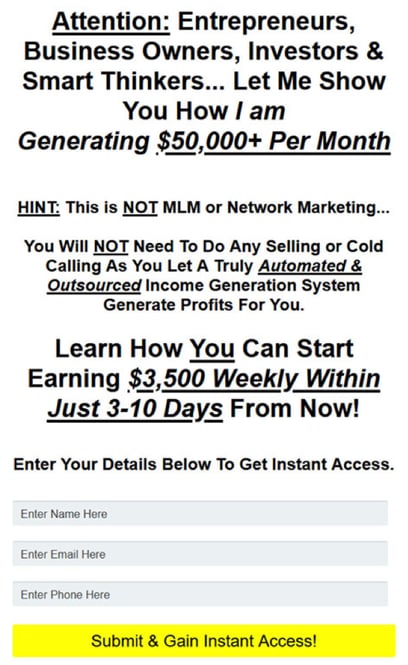

The defendants used earnings claims at multiple points in their sales funnel.

You can see income claims on the lead generation page above. There were also earnings claims made during pre-recorded cold reach outs and during the sales calls.

Remember, any time you make an earnings claim you MUST be able to prove that it is a TYPICAL result for customers in your program and not just what your most successful customers make.

Contrary to their claims, these earnings were not a typical result for customers in the program.

#4 – Testimonials Creating A Misleading Net Impression

The defendants used testimonials of customers discussing how much money they made with the program. They also included pictures of checks they supposedly sent to members.

However, these testimonials were not substantiated and did not represent typical results of customers.

#5 – Misrepresentations About The Program

A major selling point was that the program was “done for you” and “low risk.”

The net impression customers took away was that they only had to invest a small amount of money into advertising, and they would generate passive income.

According to the FTC, this was NOT the experience of most customers.

#6 – Targeting Vulnerable Groups

The complaint notes that many of the customers of this program were retirees.

The FTC is known for putting extra scrutiny on businesses that market to vulnerable groups such as the elderly, veterans and disabled.

#7 – Harsh Penalties

The total monetary judgement was more than $7.5 million.

The 3 defendants paid far less than that. The last person that settled only had to pay $100,000.

However, each were BANNED from selling or marketing money-making or investment opportunities. 2 of them were also banned from robocalls and/or telesales.

Here is the link to the FTC’s press release.

Here is the link to the complaint.

Did You Know…

In California, you have to allow a client to opt out of consent in the same manner in which they opted in.

This means that, if they bought a subscription plan online, they have to be able to cancel it online.

Quick Compliance Tip: Section 19 Simplified

The AMG Capital Management, LLC v. FTC case in 2021 was a big deal.

Before AMG Capital, the FTC used Section 13(b) to freeze assets, levy fines, collect damages, and get relief for victims.

The Supreme Court limited what the FTC could do with 13(b). The FTC had to pivot.

Instead of relying on Section 13(b) of the FTC Act to get relief for victims, they leaned more on Section 19.

Section 19 empowers the FTC to issue very targeted rules for TELEMARKETING.

Telemarketing includes different forms of “one-to-one selling.” Telephone, Zoom, the backroom of an event—anything where a sales representative is having a personal conversation is governed under Section 19.

The “Telemarketing Sales Rule (TSR)” that we reference all the time came from Section 19.

This includes, but is not limited to, falsely representing the…

- Price

- Potential returns

- Product effectiveness

- Earnings potential

- Any other representations that push a consumer into an unfair sale

Basically, Section 19 is about truthful and fair advertising practices in one-on-one situations.

Section 19 also allows the FTC to freeze assets, levy fines, collect damages, and much more.

It then comes as no surprise that the FTC is currently focusing most of their activity and investigations under Section 19.

Big Takeaway: If you sell one on one, you are at a higher risk of getting the attention of the FTC right now because of Section 19.